Does Factor Investing Still Work?

- dthenry5

- Aug 6, 2025

- 6 min read

With over a hundred years of investment market data available, the good news news is we now have a reasonable idea of where stock market returns “come from”. Decades of academic research has identified a number of reasons or “factors” which can be used to explain past returns.

Therefore, the theory goes, if we can look for stocks which exhibit these certain characteristics and invest in them - based on the historical evidence we should expect to see outperformance.

Here are some of the most commonly referred to factors:

“Market” - Investing in stocks generates a higher return over time than holding cash or bonds.

“Size” - Smaller companies and their stocks, generate higher returns than larger ones.

“Value” - More cheaply valued stocks generate higher returns than more expensive ones. Buy low, sell high in other words.

“Profitability” - The stocks of more profitable companies outperform the stocks of less profitable ones.

“Momentum” - What is working tends to continue to work in the short term.

I like a factor based investing approach for a few reasons:

It is an approach based in academic rigour. These sources of return have only been determined after thorough interrogation of the data, and have been shown to work consistently over long time periods.

All of the above factors make intuitive sense (with the possible exception of momentum). Even my simple brain can understand why they work.

This approach follows pre-established rules to determine where to invest and when. It is not reliant on qualitative research of companies, nor human “gut” feeling;

The strategy does not exclude any stocks, rather it tilts toward the stocks which exhibit the above characteristics. Therefore the overall portfolio remains “hyper-diversified”; and

It doesn’t work all of the time.

Now, this last one might seem a bit odd. But any investment strategy that purports to be a slam dunk, home run evergreen winner - well that sounds a bit free-lunchy to me. We all know (or should do by now) that no such thing exists.

I need to know where the trade offs with any action sit, so I (and my clients) won’t get caught out.

To this point, over the past ten years or so a globally diversified portfolio combining the above factors would have underperformed our “no brainer” portfolio from a couple of weeks ago. The “no brainer” portfolio being a simple whole of market, cap weighted strategy.

This being the case there are a couple of obvious follow up questions.

If our “no brainer” portfolio is the standard benchmark - why would we bother adding complexity to our lives by incorporating factors?

Well, as I said above, this approach doesn’t always work.

Each factor seems to go through periods where it falls asleep. But they always seem to wake up again, and over the long term each of these factors have destroyed market cap weighting.

As with investing in general, the prize on offer is a long term one. We should not expect constant gratification, to do so will be to ensure disappointment.

If factor investing hasn’t added value for ten years now, has it stopped working entirely?

As I mentioned above, most globally diversified factor based approaches in aggregate have lagged market cap weighted strategies over the past decade. But to find out why we need to have a look under the bonnet.

Since 2015, the value and size factors have underperformed in developed markets - but profitability has actually done just fine. So it hasn’t been a clean sweep.

At a country/regional level it is even more of a mixed bag.

Within UK markets over the past ten years, only the value factor has struggled. Size and profitability have been grand.

Same story in Europe.

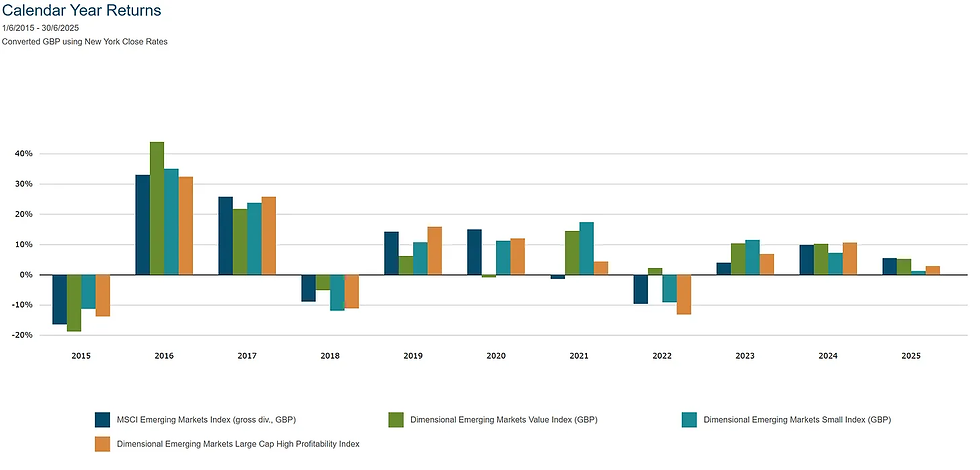

When we look at Emerging Markets, we see that all of the factors have added value over the past decade.

And consistently too. During 7 of the past 10 calendar years (including 2025 to end of June), at least two of the factors have outperformed in Emerging Markets.

So why has factor investing at the global level had a difficult decade?

Well, simply put this is a US story. Both the size and value factors have struggled in the US over the past decade, and two out of three ain’t good.

Particularly when the US currently makes up such a large portion of the global equity market. Any globally diversified strategy must, by definition, have a big slug of the portfolio in the States.

Like the arguments for the factors themselves working, the arguments for the size and value factors now starting to disappear also seem to make intuitive sense.

If private markets are expanding, and start ups can have access to more capital than ever before, why would they choose to list on an exchange and incur all of the cost and regulation that goes with that?

Listing on a stock exchange isn’t the badge of honour it once was, and therefore the best companies in the world choose to remain private for longer. The listed small cap premium therefore dies, as no truly great small companies come to market anymore.

Or, maybe the value factor dies because the biggest and best companies in the world (think the Mag-7) have gotten so big that they can continue to justify high stock valuations through constant reinvestment and acquisition. Maybe the world has changed, who knows.

But as an investor in factor based strategies myself personally, and for clients, I take comfort in the fact that the approach seems to be working in most major markets except the US. Therefore, logic would dictate, it will start working in the US too at some stage.

Now, at this stage you may be asking “well if these factors are adding value in other markets except America, then should we look to reduce our weighting to the US or eradicate it entirely in the search for outperformance?”

And if you are thinking that, then you are in luck. That is next week’s topic.

Past performance is no guarantee of future returns. None of the above is intended to constitute advice to any one individual. If you have any queries regarding your specific situation, please contact a regulated financial adviser.

Comments