How Much Can I Spend In Retirement?

- dthenry5

- Aug 27, 2025

- 4 min read

If a financial planner has one job it is to help her clients to maximise their positive life experiences using their money, while simultaneously ensuring they do not run out. It is that simple really.

And the one big liability that most folks need to prepare for is their retirement - however that may look.

If we assume that we are going to fund our retirement by drawing down from our assets at a rate of our choosing rather than buying an annuity, then the question then becomes - what is a sensible rate to choose?

So assuming an asset base of £1 million, invested sensibly into a simple diversified portfolio, one could happily expect to spend £40,000 a year (adjusted for inflation) for thirty years without fear of running out.

There is a reason that Bengen’s original work has become so revered. It was transformational for its time.

It answers a really difficult question in an elegant, evidenced way. In a way no-one had tried to do previously.

No surprise then that the paper led to the “4% rule” entering the financial planning lexicon.

But rules of thumb can only ever provide a starting point. Life often isn’t that neat and tidy.

There a few obvious downsides to simply relying on the 4% rule. These are, in no particular order:

It is inflexible. In reality you won’t just spend 4% a year every year. Life happens - the roof needs done, you may want to make one off gifts. The 4% rule doesn’t make allowances for this.

Your rate of spending will naturally change (probably decline) in real terms over time. If you start off spending 4%, you will likely end up under-spending.

4%, by definition, is the maximum amount one could have safely spent across all of the thirty year periods in Bengen’s data set. It is therefore a naturally cautious figure. Again, relying blindly upon it will very likely lead to underspending.

The 4% rule assumes a thirty year retirement journey. In reality you probably aren’t going to die exactly thirty years after you get your carriage clock from HR.

In my practice, the piece of kit I use to help clients answer this question adopts a similar approach to Bengen.

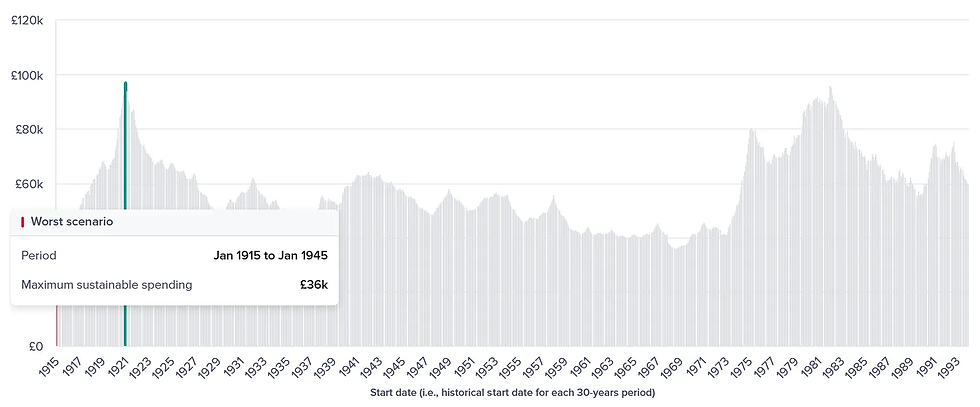

It uses historical economic and market data going back to 1915, to run hundreds and hundreds of retirement “journeys” and determines what the maximum, inflation adjusted, annual rate of expenditure was over each one.

To bring this to life, let’s consider a hypothetical client with £1 million invested (£300k in ISA, £700k in pension) in a simple 60% stock & 40% bond portfolio.

What we see is that even during the worst possible thirty year retirement journey the client could have gone on in the past 112 years - this portfolio could have supported an annual spend of £36,000. So actually a little lower than 4%.

Provided aliens don’t land in Trafalgar Square within the next thirty years, £36,000 is the amount this client should spend each year if they want to be absolutely sure they will die with some coin in the bank.

But we want to be a little more ambitious than this surely. Life is for living and all that. Ultimately the goal is to “die with zero”.

If instead of £36,000 we budget for spending £50,000 - this software provides us with a percentage probability that the client will be ok. This score is based on the number of historical scenarios where this rate of expenditure would be sustainable.

And in this case, £50,000 of annual inflation adjusted spend would have been affordable in 75% of the scenarios modelled.

This is fine. And not “this is fine” in the cartoon dog sitting in a burning house sense - it is actually fine.

For we do not want to see a 100% probability of our money lasting longer than our lives, because that means we also have a 100% chance of spending less than we could have while alive. Both on ourselves, and on others.

People spend less as they age as well, so it makes particular sense to be aggressive in the earlier years.

By going through an exercise like this in the run up to retirement, at retirement and on an ongoing basis post retirement - we can adjust and tinker based on changing circumstances and “events, dear boy”.

We can also give ourselves the best chance of getting maximum utility (fun!) out of our money. And that is kind of the whole point right?

Past performance is not indicative of future returns. None of the above is intended to constitute advice to any individual. If you have questions about your specific situation, then please do consult with a regulated financial adviser.

Comments