Trump & Tariffs

- dthenry5

- Apr 10, 2025

- 6 min read

Well - I didn’t have “autarky” on my bingo card as word of the year for 2025.

“Autarky refers to a state of economic self-sufficiency, where a country, region, or entity aims to be entirely independent and not rely on external trade or resources.

In an autarkic system, all goods and services needed for survival and prosperity are produced domestically, minimizing reliance on imports or foreign influences. Historically, some nations have pursued autarky as a political or economic strategy, often during times of war or economic crisis.

However, achieving full autarky is quite rare, as most economies benefit from international trade and specialization.”

Microsoft Copilot

Last Wednesday, Donald Trump “finally shot the hostage” - announcing a range of tariffs on foreign imports into the US.

Imports from countries as diverse as the UK, Canada and the Heard & McDonald Islands (a body of land populated solely by penguins) were going to be subject to tariffs of at least 10%, until last night’s pause for countries who had not yet announced retaliatory tariffs (basically everyone except China).

Mr Trump justifies this policy by saying that this will protect US jobs which have been lost overseas and reinvigorate industry decimated by cheaper foreign competitors.

Economists who disagree regard tariffs as a “negative sum game” - mutually assured economic destruction which is likely to increase the cost of living for the most vulnerable in the US and cause a recession there as well as globally.

For what it is worth, and for the time being, the stock market seems to agree with the latter view.

Tariffs = bad. Pause in tariffs = good.

Now, I am not an economist. I think it’s kind of important to stay in your lane and I don’t have a properly informed view on whether these tariffs are a good or a bad idea - or even if they will ever fully see the light of day. I guess we will see.

But it is always handy in the future to have a record of what we were thinking about in real time during periods like this, so I’ve jotted down some of the thoughts on the matter that I’ve had over the past week.

This all feels horribly binary.

I’m not sure the dispersion of outcomes is too wide here - it seems to be a simple fork in the road.

Up until yesterday evening it felt like the US and the rest of the world were locked in a game of “economic chicken”. The US have backed off a little bit, but there seems to be no doubt that the global order has changed.

At the moment it feels like policy can move around at the drop of a hat depending on which side of the bed Mr Trump gets out of - and markets are thrashing around accordingly.

Tesla stock was up 22% yesterday. TWENTY-TWO. One of the biggest companies on the planet and it is trading like a micro cap.

At times like this, even modest portfolio maintenance can be dangerous. I usually place “Bed & ISA” trades for clients early in the tax year to move assets into tax free ISAs as soon as possible - but at the moment it feels dangerous to be temporarily out of the market for any length of time (as we saw from yesterday’s bounce).

Whatever ends up happening will feel completely obvious with hindsight.

“Two possible outcomes;

Trump is dead serious about tariffs. He’s going to go through with it no matter how much pain it inflicts on the economy. He recently said, “I couldn’t care less, because if the prices on foreign cars go up, they’re going to buy American cars…I hope they raise their prices, because if they do, people are going to buy American-made cars. We have plenty.”

If these policies tank the economy and the market, everybody is going to be singing the same chorus. “HE TOLD YOU HE WAS GOING TO DO THIS. HE CAMPAIGNED ON IT. WHY DIDN’T YOU BELIEVE HIM?!?!?!?!”

Or.

Trump softens up. He makes a deal and quiets the chaos he created. He’ll call it a yuge win for America. And everything goes back to the way it was. Mag 7 leads the way as we hurl towards an AI revolution. And everybody will be singing the same chorus. “HE’S A RICH GUY. YOU THOUGHT HE WAS GOING TO TANK THE MARKET?!?!? HOW DUMB ARE YOU?

This will be the most obvious outcome ever in hindsight.”

Trump’s new tech bro mates won’t be too happy.

Amazon, Apple, Tesla, Nvidia, Google, Microsoft and Meta share price performance since 23rd January:

Last night’s mega bounce has obviously helped, but a few of these names are still in fairly ugly drawdowns. And I don’t care how rich you are, when the vast majority of your wealth is tied up in one company, and that stock is down 30%, you notice.

The bond market is undefeated.

I don’t think it is a coincidence that the White House rowed back yesterday, shortly after US treasuries sold off.

A rise in borrowing costs matters to governments. As we experienced here in the UK in 2022 - the bond market can inflict a lot of pain when it doesn’t buy what a government is selling.

There is no “template” for a stock market bottom.

One of the (many) reasons that it is impossible to time investment into, or out of, capital markets is that in the short term markets move based on news flow relative to the aggregate level of expectations. And no-one really knows where those expectations are set in real time.

I am afraid to report that no-one will come out and declare that the point of maximum pessimism has been reached and it is only up from here.

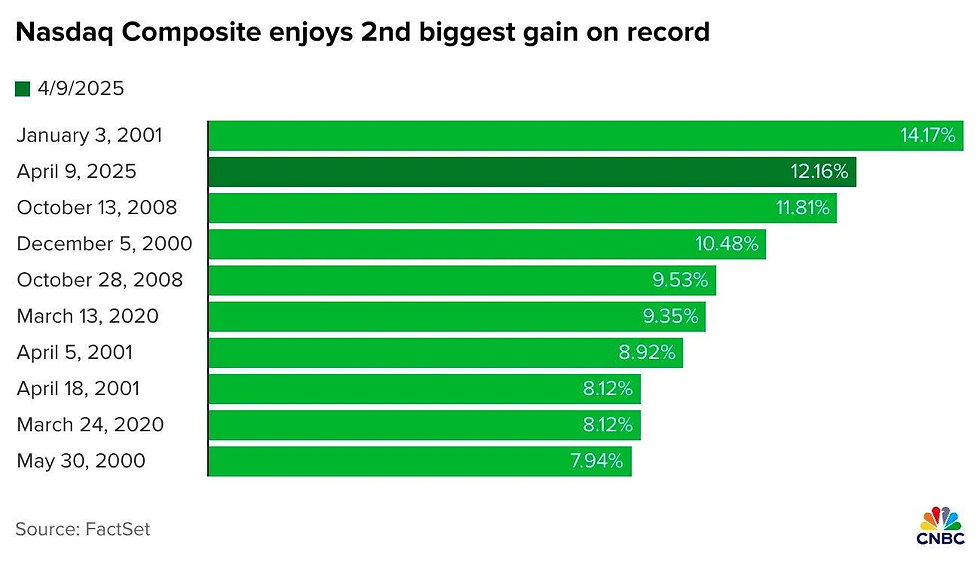

A mate shared the below with me this morning, which places yesterday’s move into context.

Two things - all of the above moves took place during horrible bear markets. And only one marked “the bottom” for those bear markets (March 24 2020).

It is rare therefore that the market bottoms on a big “up day” when everyone jumps back into the pool, but it is not unprecedented.

The “overnight experts” will be out in force. Pay them no mind.

If the situation is pretty binary, and seemingly dependant on the whims of one bloke - you might think it would be a time for humility.

But times like this are catnip to the same people that became amateur epidemiologists five years ago and geopolitical experts when Russia invaded Ukraine.

Ignore the siren song of certainty. Anyone who seems to think it is obvious what is coming down the pipe is either ignorant or trying to flog you something.

Stats help at times like this. But not much.

The table below shows every bear market for the S&P 500 going back to the 60’s.

And the below table shows the average one, three and five year returns for the global stock market from any point where it was in a 20% drawdown or higher, going back to January 1970.

Historical context helps during times like these, but only to the extent that is helps set expectations at realistic levels.

What gets investors through difficult periods is their temperament. A level-headed investor with a sub-optimal investment strategy beats a chaotic investor with the perfect portfolio every day of the week.

To that end, trying to put yourself in the best frame of mind to make good decisions (or at least to avoid bad ones) is the name of the game.

Get enough sleep, exercise, relax - just try to live your life safe in the knowledge that things are going to shake out how they shake out.

None of the above is intended to provide investment advice. Past performance is no indicator of future returns.

Comments